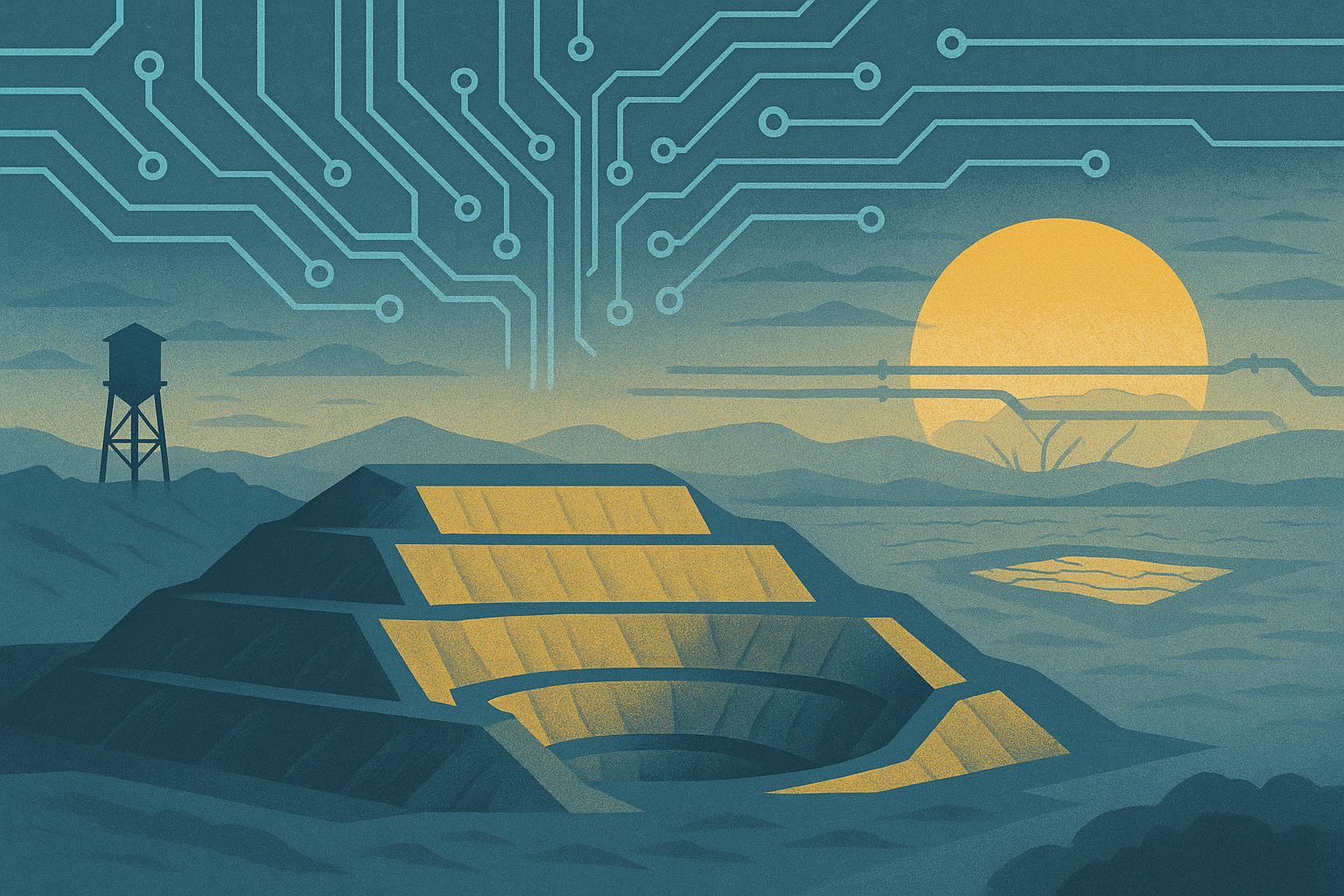

A mounting climate threat to copper supply could endanger one-third of global semiconductor production within the next decade, according to a new report by PwC. The study finds that worsening droughts in copper-producing regions risk disrupting the flow of a metal essential to every chip made — and for which no viable substitute exists.

Copper’s role in semiconductors is foundational. Billions of microscopic copper wires connect transistors across every integrated circuit, and the metal’s unmatched conductivity makes it critical to next-generation process nodes. But extracting and refining it requires large volumes of water — up to 1,600 litres to produce 19 kilograms of concentrate — making production acutely vulnerable to climate volatility.

At present, around 8% of global chip output is exposed to drought-related copper disruption. By 2035, that share is expected to rise to 32%, and could reach 58% by mid-century under a high-emissions scenario. PwC’s modelling draws particular attention to 17 copper-supplying nations that feed the chip sector, many of which are forecast to see sharp increases in water stress over the next two decades.

Some producers are better positioned than others. Chile and Peru — two of the world’s top copper exporters — have cut their immediate exposure through desalination projects and water-efficiency measures, holding current risk to around 25% of production. But these gains may not hold: by 2050, up to 100% of their copper output could face drought-related disruption, PwC warns.

Inland producers such as China, the Democratic Republic of Congo, and Mongolia have fewer water-mitigation options. With climate variability intensifying, these regions may face more erratic output swings and longer recovery timelines — adding volatility to already tight markets.

The global economy has already experienced the ripple effects of semiconductor shortages. Between 2020 and 2022, constrained chip supply reduced US GDP growth by one percentage point and shaved 2.4 points off Germany’s, largely by disrupting automotive and electronics manufacturing. A copper-driven supply shock could trigger similar cascades — but with longer lead times to recovery.

Markets are showing signs of strain. Copper recently traded near US$10,000 per tonne amid tariff fears and depleted London Metal Exchange inventories. Looking ahead, the International Energy Agency forecasts a 30% supply-demand gap by 2035 unless new production comes online, while BHP estimates that AI-related data centre build-out could add a further 3.4 million tonnes of annual demand by 2050.

Policy signals are starting to shift. India is moving to attract foreign copper miners and build out domestic smelting capacity, a strategy PwC identifies as a necessary hedge against regional bottlenecks. Chipmakers, meanwhile, are being urged to map physical climate risk into procurement and capital plans — a step PwC says is critical to avoiding repeat crises.

Mitigation options include scaling up water access at source through desalination and closed-loop recycling, qualifying additional smelters to diversify supply chains, and raising the recycled copper content in mature markets — which can already meet up to 30% of demand. PwC also stresses the importance of materials R&D, though it notes that alternative interconnects such as aluminium alloys and graphene remain years from commercial readiness.

Without rapid adaptation, the report concludes, the semiconductor sector may find itself once again exposed to a raw material shock — this time driven not by logistics or geopolitics, but by water.