-

The Bank of England signals limited interest rate cuts ahead. Officials suggest interest rate cuts may not continue indefinitely, citing inflation concerns and market expectations. The central bank faces challenges with inflation and borrowing costs, impacting future monetary policy decisions.

-

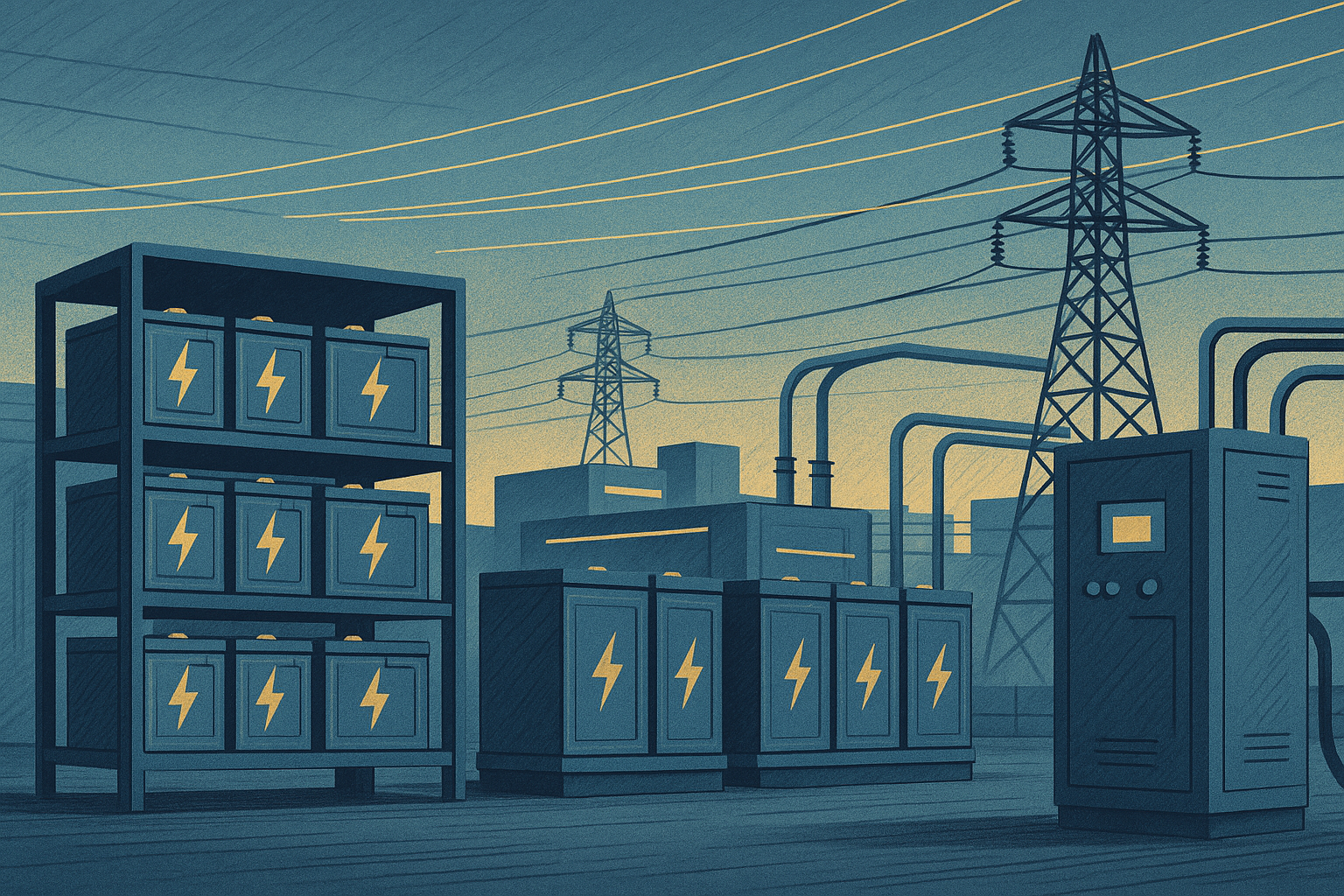

Palmer Energy Technology has acquired Oxford spin-out Brill Power. The deal, alongside a £5 million Series A round, will support deployment of Brill’s battery management systems across UK energy storage projects.

-

UK services growth surged to a 16-month high in August. The S&P Global/CIPS PMI rose to 54.2, signalling stronger demand across business services, hospitality, and transport, as inflationary pressures eased and overseas demand picked up.

-

Chancellor Rachel Reeves will present her first full autumn budget. The Treasury has announced the date as 26 November, with speculation over potential tax increases to address a public finance shortfall of up to £40 billion.

-

Wood Group nears Sidara takeover as Boots goes private. The UK M&A market saw high-profile transactions this week, spanning energy, retail, fashion, infrastructure, and leisure. From Wood Group’s contested future to Boots’ transition into private ownership, the breadth of deals underscores both sector diversity and investor appetite.

-

Lotus plans to cut 550 UK jobs to ensure survival. The Norfolk-based carmaker, majority-owned by Geely, cited falling sales, electric vehicle transition, and global tariffs as reasons for the cuts, which affect 40% of its British workforce.

-

The UK is becoming a top destination for tech businesses. Barclays reports that UK tech leaders favour their market over Europe, Asia-Pacific, and the US, citing strong opportunities and talent access. Rising AI demand and economic confidence bolster growth.

-

Ineos invests in Castore, shifting Belstaff ownership in strategic deal. The company’s strategic investment in sports apparel brand Castore facilitates Castore’s acquisition of heritage brand Belstaff, marking a shift towards luxury fashion.

-

Wood Group backs Sidara’s new 30p offer amid FCA probe. The Aberdeen-based engineering group is “minded to recommend” a revised takeover offer from Dubai’s Sidara, despite suspended trading, delayed accounts, and ongoing scrutiny from the UK’s financial watchdog.