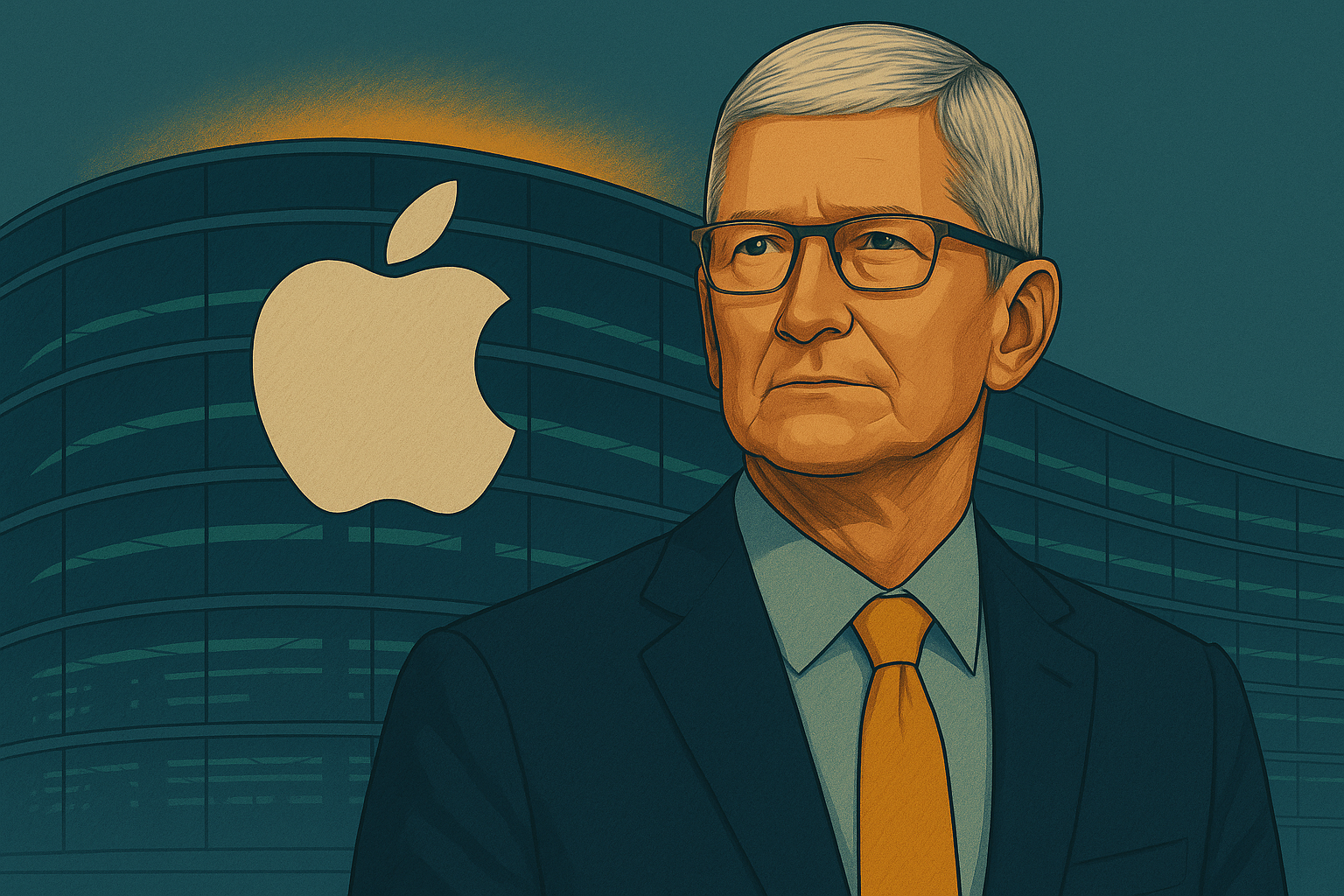

Apple is intensifying preparations for a change at the top, according to reports that the technology giant’s board and senior leadership have begun detailed planning for Chief Executive Officer Tim Cook’s eventual departure.

The Financial Times said over the weekend that Apple’s directors are taking a more active role in identifying potential successors, with a view to ensuring a seamless hand-over when Cook steps down. The company has not publicly commented, but sources cited by the paper described the planning as “well advanced”.

John Ternus, Apple’s senior vice-president of hardware engineering, is understood to be the leading internal candidate. Ternus has overseen the company’s transition to its own Apple Silicon chips and is regarded as a trusted figure within the organisation. No formal decision has been made, and Apple is expected to delay any announcement until after its January 2026 earnings report — a period that includes the key holiday sales quarter.

Cook, who turned 65 this month, has led Apple since 2011, steering it through more than a decade of growth that saw its market capitalisation rise from around US$350 billion to roughly US$4 trillion. Under his leadership, Apple expanded beyond hardware into a global services ecosystem, driving recurring revenue through subscriptions and digital content.

The succession effort is not understood to reflect any operational issues. The company is on track for a strong financial close to 2025 and continues to hold dominant positions in smartphones, wearables, and consumer services. Yet with Cook marking more than a decade and a half in the role, governance observers say the timing for transition planning is prudent.

Cook himself has previously noted that Apple maintains “very detailed succession plans” across all leadership levels — a remark made during a 2021 interview that underscored the company’s institutional approach to continuity.

From a market perspective, Apple’s share price has gained about 12 % this year — solid but behind peers such as Nvidia and Microsoft, whose valuations have surged on artificial-intelligence momentum. Analysts suggest that Apple’s next phase will hinge on deeper AI integration, ecosystem expansion, and continued diversification beyond the iPhone.

The appointment of Cook’s eventual successor will mark one of the most closely watched corporate transitions in recent memory. Whether continuity or reinvention follows may define Apple’s trajectory for the next decade — and the next trillion dollars of value.