-

European M&A ended 2025 with disciplined, strategically focused December deals. Orange’s €4.25bn move for full control of MasOrange set the tone. Sanofi and Sweden’s Sobi paid for pipeline clarity, Harman bought German ADAS capability, and Prada’s Versace acquisition underlined that European luxury consolidation remains firmly alive.

-

The U.S. consumer watchdog faces paralysis as funding cuts bite. A judge has ordered the Trump administration to restore payments to the Consumer Financial Protection Bureau, halting its attempt to defund the agency as tensions over America’s regulatory future intensify.

-

UK ranks lowest in G7 for investment despite government plans. Total investment is 18.6% of GDP, trailing other G7 nations. Labour aims to boost public spending, but private investment may not follow, citing weak business confidence.

-

December reshaped UK dealmaking, from energy divestments to takeovers worldwide. BP’s Castrol carve-out set the tone, while Smiths, Petrofac, SolGold, and International Personal Finance highlighted continued appetite for UK assets. The month revealed how capital is being deployed — selectively, strategically, and with little tolerance for ambiguity.

-

Octopus Energy will spin off Kraken tech platform Kraken at $8.65bn valuation. The demerger reflects growing investor appetite for utility software, with the platform set to become an independent company backed by global institutions. The move marks a new chapter in UK energy tech.

-

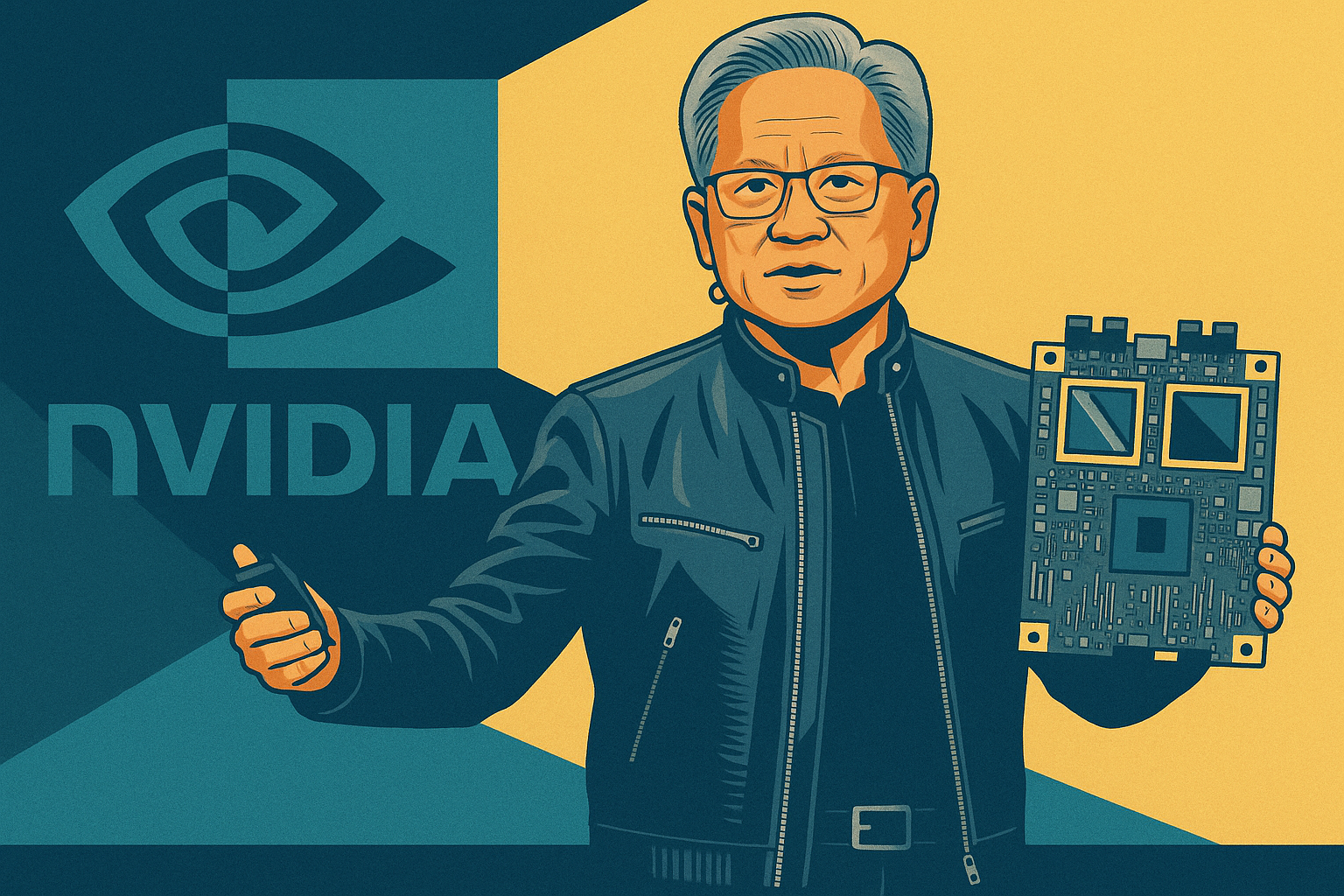

Nvidia finalised its $5 billion acquisition of Intel stock under a September agreement. The 214 million-share purchase marks a deepening alliance between two of the world’s most influential chipmakers. The transaction strengthens Intel’s financial footing while aligning the pair on future chip design and AI development.

-

Older millennials are seeking more mental health support than ever. Between 2023 and 2025, Onebright saw a steady rise in referrals from 35–46-year-olds as middle management pressures, childcare, and financial stress converge — marking a growing crisis in workplace wellbeing among senior professionals.

-

Relocation requests are rising among Israel’s high-tech employees. A new report shows that more than half of multinational tech companies operating in Israel have seen an increase in staff seeking moves overseas, reflecting wider unease amid conflict and shifting confidence in the country’s innovation economy.

-

China’s ByteDance is preparing to spend $22.7 billion on AI infrastructure in 2026. The TikTok owner’s planned investment underscores Beijing’s determination to stay competitive in artificial intelligence amid US export controls and intensifying Western capital commitments.

-

John Carreyrou files a federal lawsuit against six AI developers. The complaint alleges the companies used copyrighted books, including his own work, without consent to train their chatbots — opening a new front in the industry’s deepening legal battle over training data.