-

US-backed buyers led five major UK M&A deals this week. Boardroom shifts, valuation gaps, and sector-specific drivers shaped property, industrials, and tech transactions, with most deal value remaining in the mid-market.

-

Britain’s economy shrank 0.1 percent in May, marking two monthly declines. The latest official data showed manufacturing and construction weighed on growth despite a mild services uptick, pushing GDP further below expectations and raising questions over the UK’s near-term economic outlook.

-

Brillian UK, part of Constellation Software, has acquired Trakm8. The court-approved takeover values Trakm8 at £7.8 million, with delisting from AIM scheduled for 10 July. The 9.5p per share deal represents a 280% premium, underscoring continued overseas interest in UK vertical software assets.

-

Legal & General and Blackstone have agreed a major new partnership. The deal could see up to $20 billion of annuity premiums invested in US investment-grade private credit over five years, marking one of the largest cross-Atlantic insurance–asset management tie-ups in the sector.

-

Clarity AI acquires ecolytiq to enhance climate engagement solutions. Clarity AI aims to bolster its climate engagement capabilities for global banking institutions through the acquisition of ecolytiq, a firm specialising in climate engagement solutions for financial services….

-

The Bank of England has adjusted its mortgage lending rules. From July 2025, individual UK lenders may exceed the 15% cap on high loan-to-income mortgages, provided the overall market remains below this level. The temporary relaxation takes effect immediately via an interim waiver.

-

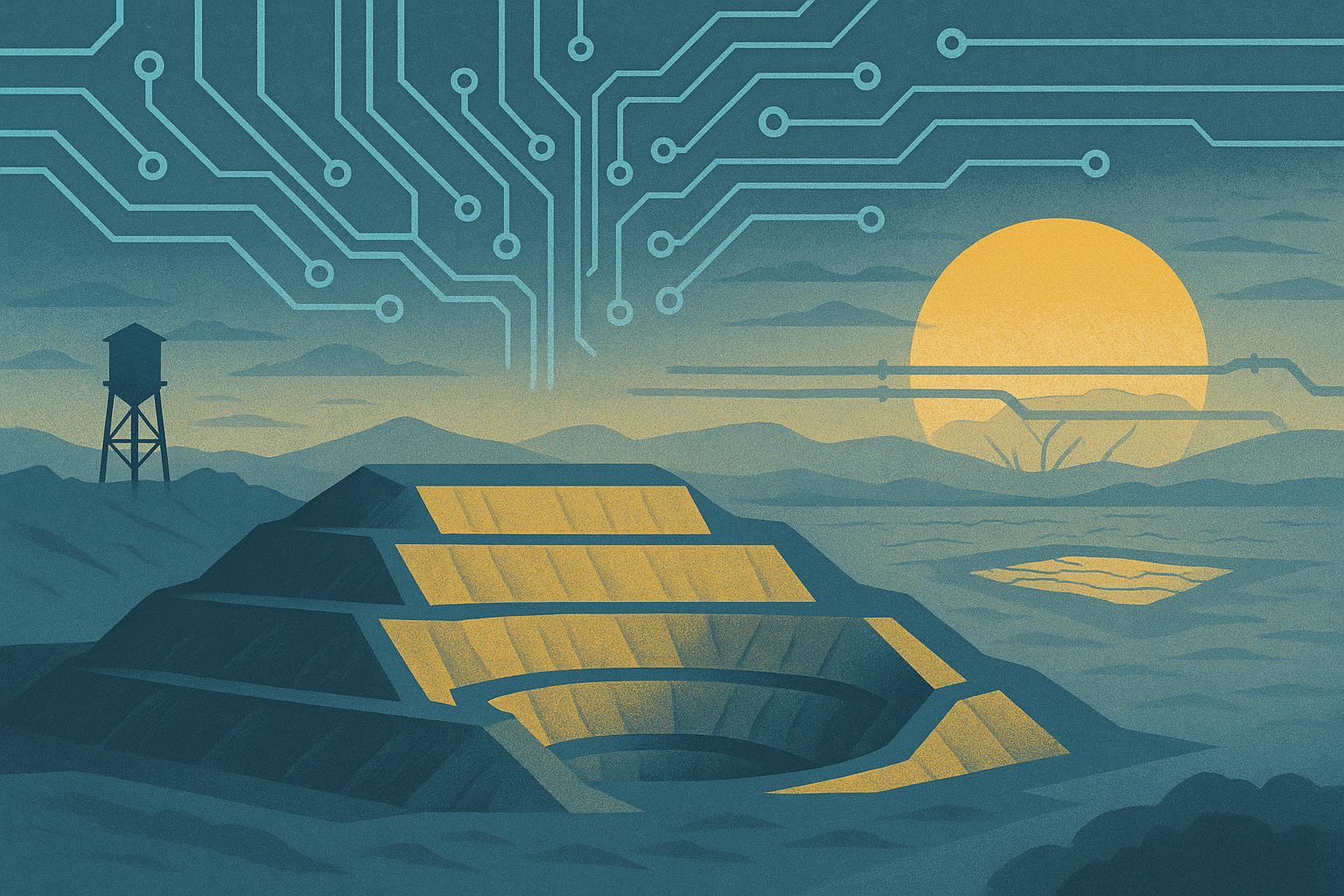

One-third of global chip production is at drought risk. A new PwC report warns that climate-driven copper disruption could impact 32% of semiconductor capacity by 2035, with supply chains for electronics, cars, and clean energy facing compounding exposure as water-stressed mines falter.

-

Five US transactions lifted M&A volumes in a shortened week. Regulatory clarity and strategic appetite drove landmark acquisitions by HPE, Home Depot, Boeing, AbbVie, and Thoma Bravo, marking a renewed focus on scale, sector positioning, and technology leadership.

-

Foreign buyers drove this week’s top M&A deals in Britain. UK assets continued to attract overseas and private-equity capital, with five major transactions totalling more than £18 billion announced or completed across financial services, industry, and property sectors.

-

Inflation in the euro area rose to 2% in June. The European Central Bank’s preferred gauge returned to target, led by persistent service-sector pressure even as energy prices fell again.