-

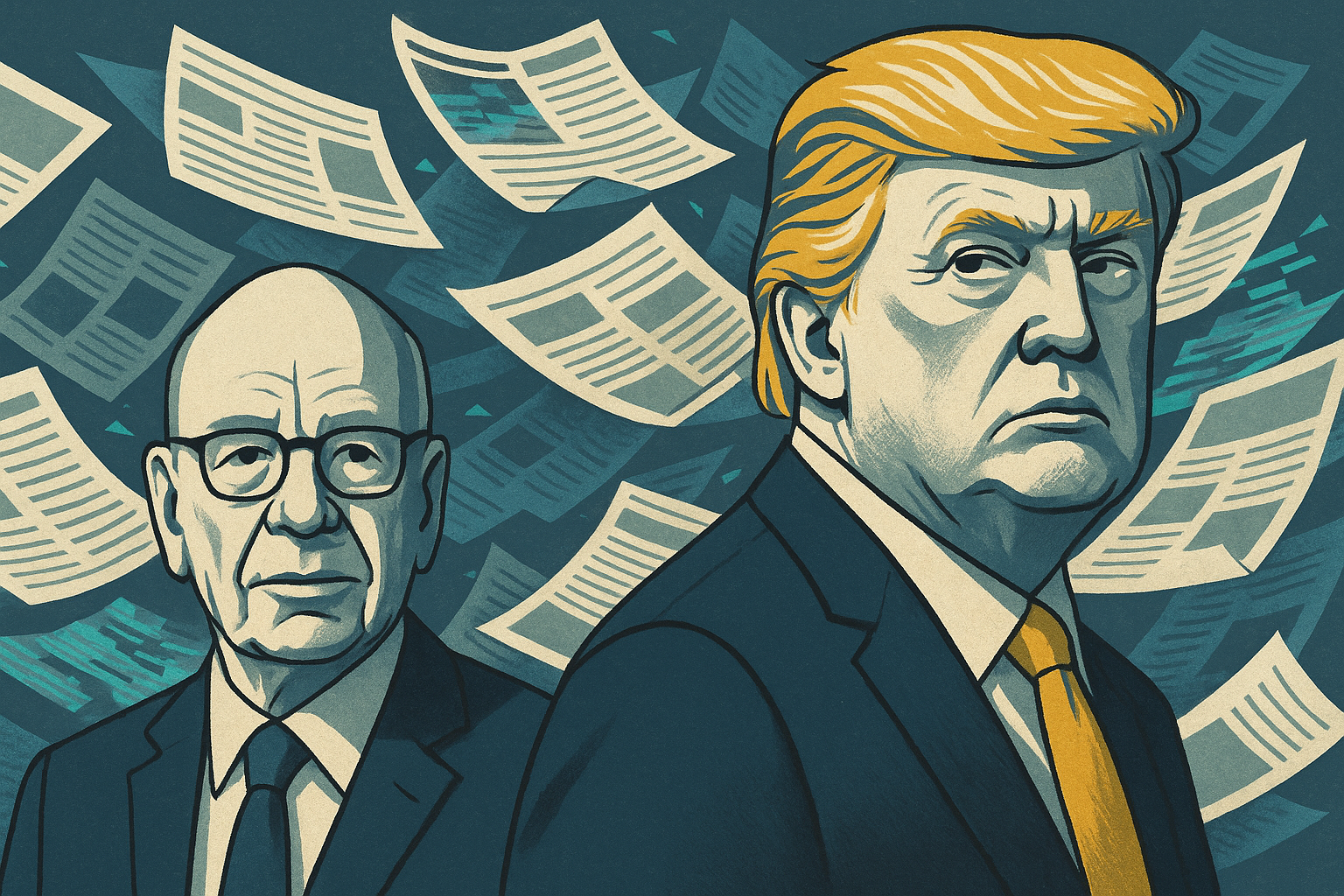

News Corp warns Trump his books are targets for AI ‘theft’. News Corp has publicly cautioned Donald Trump that artificial intelligence tools are cannibalising the content of his books — including The Art of the Deal — as the company intensifies its calls for stronger copyright protection in the age of generative AI.

-

US tariffs on semiconductor and drug imports could reach 250%. Markets face uncertainty as technology and healthcare companies brace for higher costs and new supply-chain disruption in the wake of President Trump’s latest trade escalation and fragile international talks.

-

Spectris has accepted a £4.2 billion takeover by KKR. The agreement follows months of public bidding and multiple revised offers, marking the conclusion of a high-stakes battle between two major private equity groups and signalling renewed global interest in UK mid-cap industrials.

-

Labour faces calls to impose VAT on private healthcare. Former Labour leader Lord Kinnock suggests this could generate over £2 billion annually in funding for the NHS, amid growing pressure on the government to address fiscal shortfalls.

-

New powers for the Small Business Commissioner aim to tackle late payments. The average UK SME is owed more than £20,000, according to FSB data. Chronic late payment is now a defining risk, amplifying the impact of high costs, inflation, and energy prices for small businesses.

-

A fifth rate cut looks likely despite persistent inflation signals. With the labour market cooling and GDP contracting, the Bank appears ready to resume easing. Our read: a divided MPC will vote for a 25bps cut, with caution in its tone but confidence in direction.

-

The UK’s M&A market saw five major deals this week. Strategic buyers, from Wall Street banks to dairy giants, drove activity across financial services, consumer, and biotech sectors. Global capital, succession, and sector shifts shaped the dealmaking landscape.

-

Evercore is buying boutique advisory firm Robey Warshaw for £146 million. The deal, expected to close in Q4 2025, adds strategic firepower to Evercore’s UK and European ambitions, bolstering its credentials in high-value M&A advisory and expanding its reach in cross-border transactions.

-

CRH to acquire Eco Material for $2.1 billion. The acquisition of Eco Material will enhance CRH’s supply chain, expand its distribution network, and strengthen its position in sustainable cement alternatives, addressing the growing demand for low-carbon construction solutions in North America….

-

Müller acquires Biotiful Gut Health, entering functional yogurt sector. The acquisition allows Müller to access the growing market for natural health products. Biotiful will continue independently, with Müller supporting growth and innovation. Financial terms remain undisclosed.