-

This week’s M&A activity spanned consumer wellness, technology infrastructure, managed services, market infrastructure, and financial markets. From Supreme’s expansion into diet brands to the London Stock Exchange Group’s strategic restructuring, UK companies focused on repositioning for scale, efficiency, and capability rather than outright size.

-

UK financial system faces rising geopolitical and cyber threats. Nikhil Rathi, FCA Chief Executive, warns of inadequate preparedness against threats affecting financial stability, insurance coverage, and systemic risks, urging enhanced collaboration and investment to bolster resilience and operational strength.

-

Airbus, Leonardo and Thales plan joint European space venture. The new entity will consolidate their satellite, systems and services businesses into a single organisation, strengthening Europe’s strategic autonomy in space and enhancing competitiveness against global rivals.

-

UK inflation held at 3.8% for the third straight month. Annual consumer price inflation remained unchanged in September, according to the Office for National Statistics — extending a run of above-target readings that continues to test monetary and fiscal policy alike.

-

Allica Bank acquires fintech Kriya to boost SME lending capacity. The acquisition, announced on Wednesday, is Allica’s third, following its purchase of Allied Irish Bank’s SME portfolio and Tuscan Capital. Allica aims for £1bn in working capital finance.

-

The top 1% of UK taxpayers paid a third of taxes. HMRC data shows the top 500,000 taxpayers paid £93.8 billion in 2023/24, comprising 33% of income and capital gains tax receipts. Wealth Club warns against deterring high net worth individuals.

-

UK government borrowing has exceeded forecasts by billions of pounds. Higher-than-expected interest costs and inflation-linked spending have tightened fiscal head-room for Chancellor Rachel Reeves ahead of the November Budget, leaving limited room to rebuild the Treasury’s buffer.

-

Getty Images and Shutterstock merger faces UK competition probe. The UK’s Competition and Markets Authority (CMA) is set to conduct an in-depth investigation into the $3.7bn merger between Getty Images and Shutterstock due to concerns over potential competition reduction.

-

The UK government has unveiled the “Sterling 20” initiative. It brings together 20 of the country’s largest pension funds to channel capital into domestic infrastructure, affordable housing, and high-growth sectors including AI. The move marks a coordinated effort to boost long-term investment in the British economy.

-

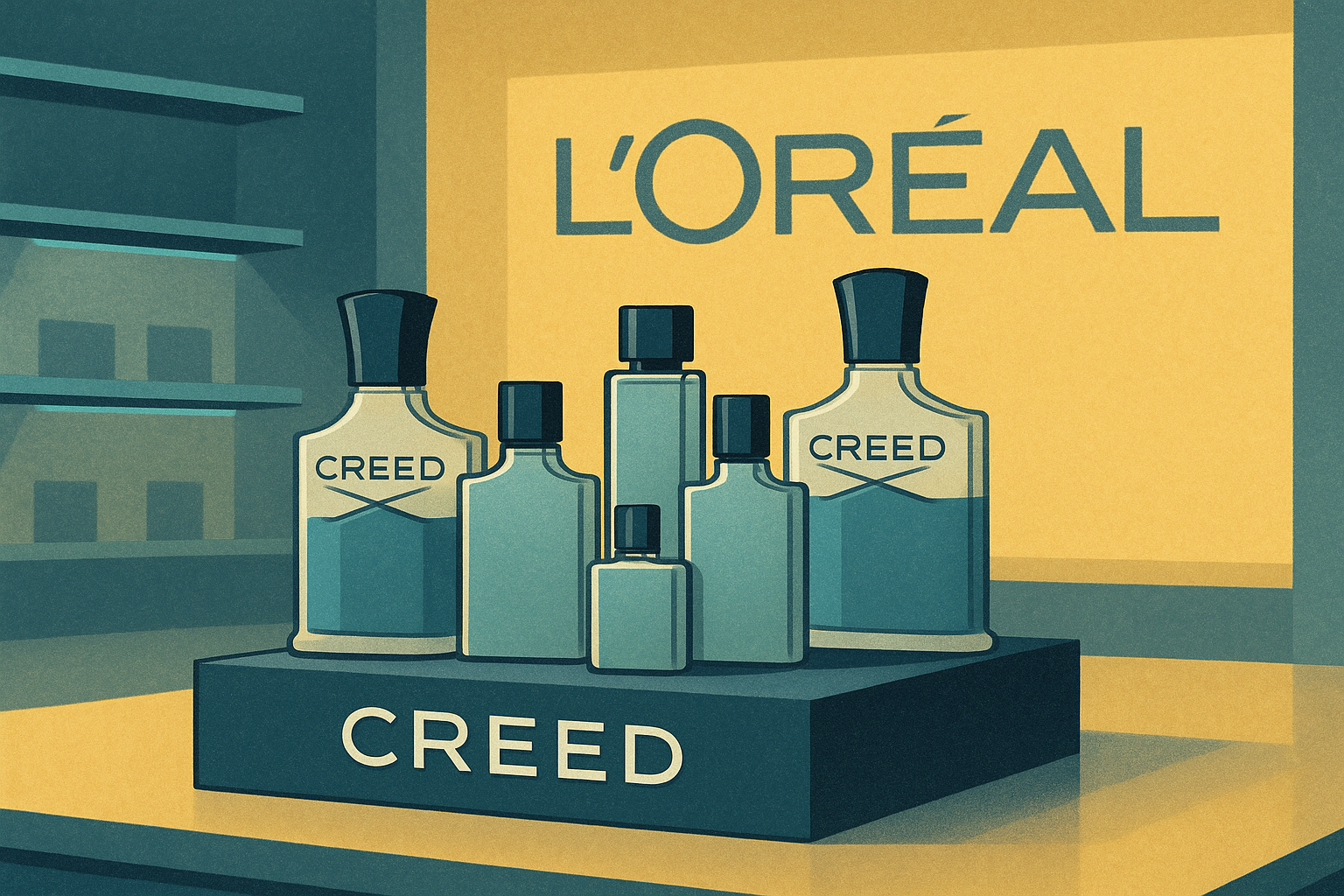

Kering will sell its beauty division to L’Oréal for €4 billion. The deal marks a strategic shift for the luxury group, which is refocusing on fashion and easing a debt load built up through recent acquisitions and property investments.