-

This week’s M&A activity spanned consumer wellness, technology infrastructure, managed services, market infrastructure, and financial markets. From Supreme’s expansion into diet brands to the London Stock Exchange Group’s strategic restructuring, UK companies focused on repositioning for scale, efficiency, and capability rather than outright size.

-

Airbus, Leonardo and Thales plan joint European space venture. The new entity will consolidate their satellite, systems and services businesses into a single organisation, strengthening Europe’s strategic autonomy in space and enhancing competitiveness against global rivals.

-

Allica Bank acquires fintech Kriya to boost SME lending capacity. The acquisition, announced on Wednesday, is Allica’s third, following its purchase of Allied Irish Bank’s SME portfolio and Tuscan Capital. Allica aims for £1bn in working capital finance.

-

Getty Images and Shutterstock merger faces UK competition probe. The UK’s Competition and Markets Authority (CMA) is set to conduct an in-depth investigation into the $3.7bn merger between Getty Images and Shutterstock due to concerns over potential competition reduction.

-

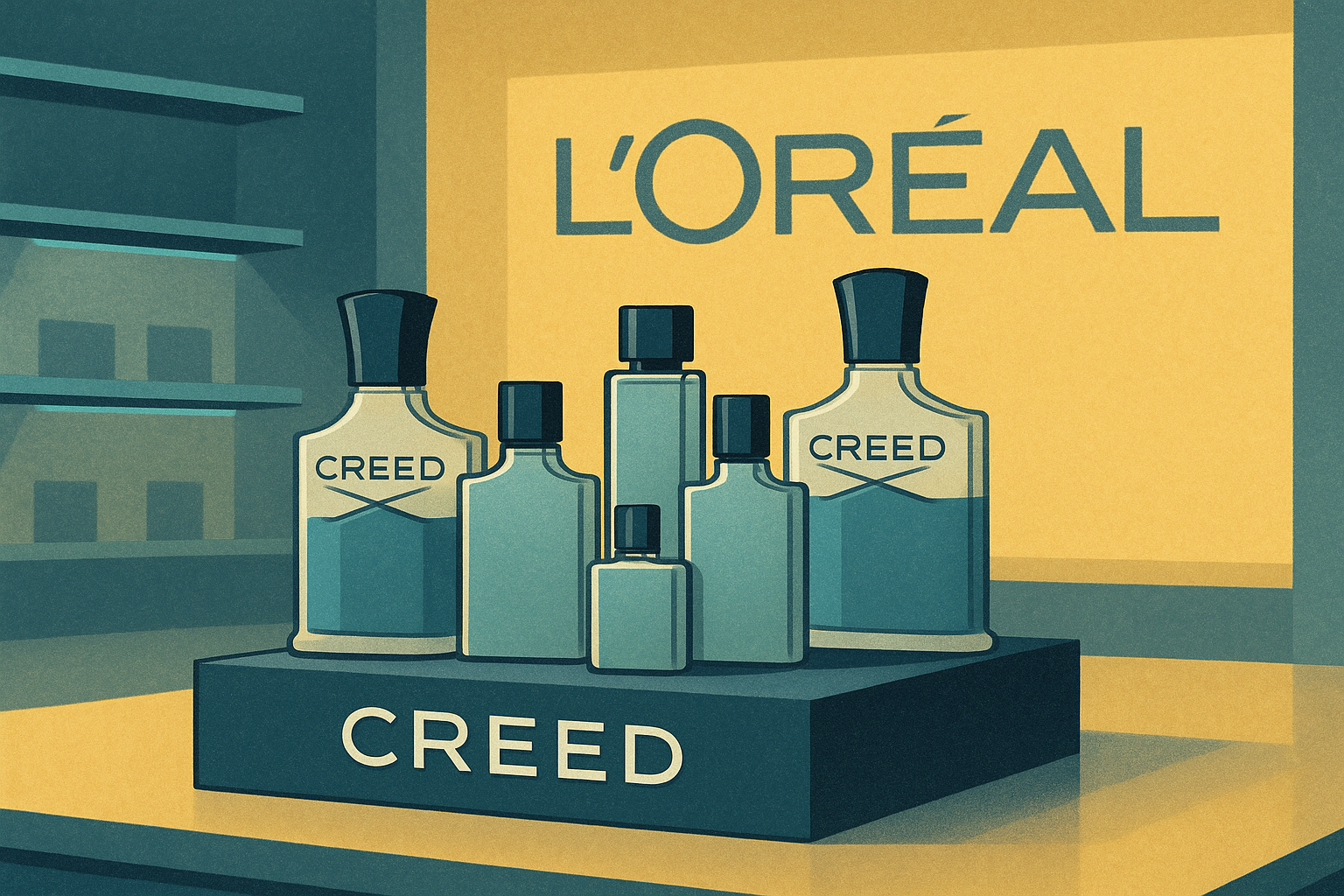

Kering will sell its beauty division to L’Oréal for €4 billion. The deal marks a strategic shift for the luxury group, which is refocusing on fashion and easing a debt load built up through recent acquisitions and property investments.

-

This week’s M&A activity spanned industrials, logistics, infrastructure, and professional services. From a £1.3 billion carve-out in manufacturing to a landmark logistics portfolio transfer, the UK remained a focal point for global buyers refining strategy, scale, and sector exposure.

-

This week’s UK M&A activity spanned engineering, wealth, insurance, and technology. From WSP’s £363 million purchase of Ricardo to Lloyds’s move for Schroders Personal Wealth, dealmaking reflected global appetite for regulated and technical sectors, where scale, integration, and specialist expertise continue to shape the direction of corporate consolidation.

-

Worldly acquires GoBlu to unify sustainability data systems. Worldly has acquired GoBlu, enhancing its capacity to track social and environmental performance in consumer goods supply chains, aiming to create a more cohesive and efficient system….

-

WSP finalises its £363 million purchase of Ricardo PLC. The transaction brings the British environmental consultancy under Canadian ownership and strengthens WSP’s position in sustainability and infrastructure advisory services, following regulatory approvals and delisting from the London Stock Exchange.

-

Novata acquires Atlas Metrics to expand sustainability data solutions. The acquisition enhances Novata’s reach, supporting over 400 clients globally with advanced ESG management tools, aligning with its mission to transform sustainability data into business resilience….