-

A decisive week for UK M&A activity, marked by global buyers. Four out of five headline deals this week involved foreign acquirers or sponsors, reinforcing perceptions of UK-listed value and highlighting continued regulatory pragmatism.

-

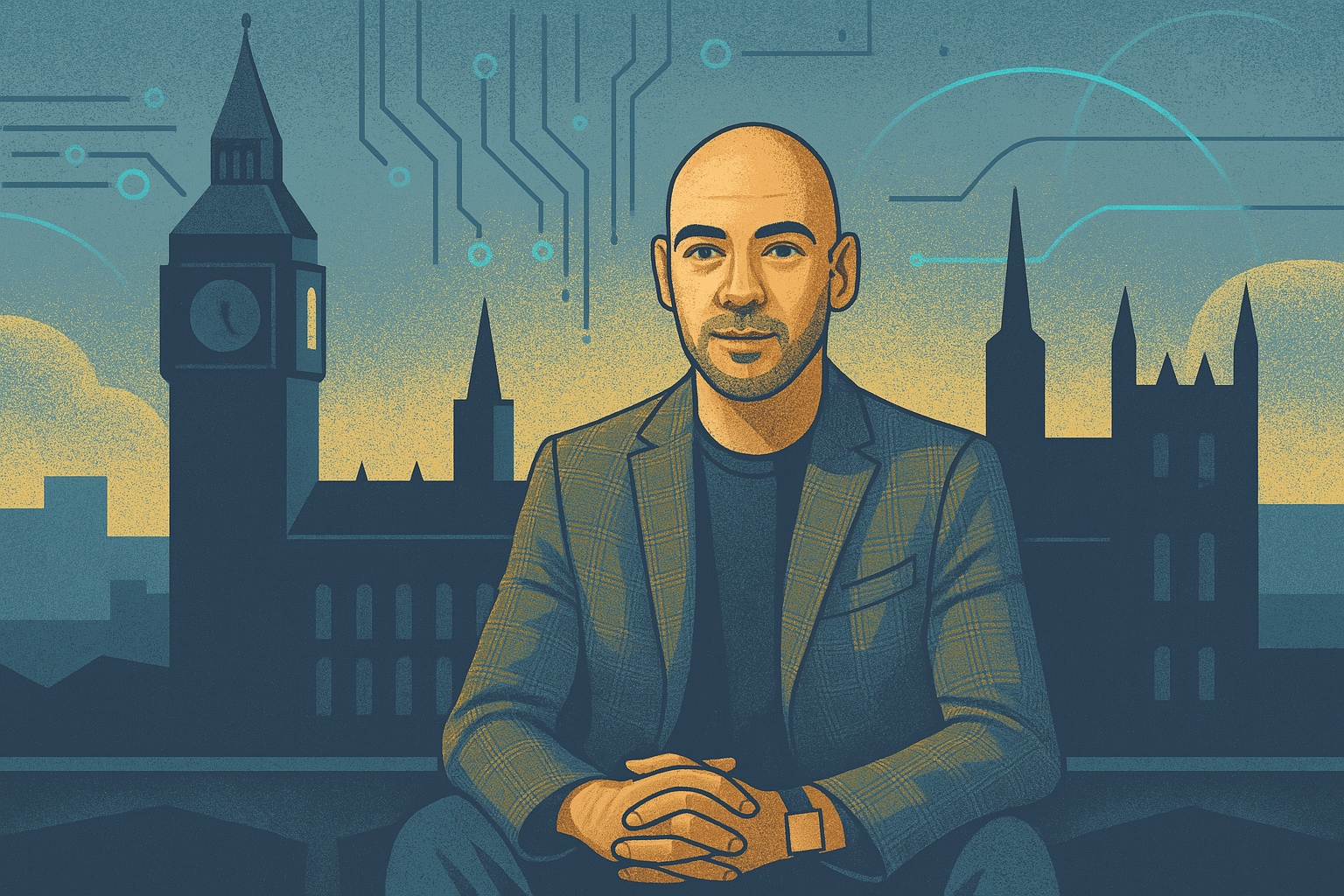

Leon Emirali built his reputation as a sharp political operator. After leaving Westminster in 2020, he became a tech founder determined to modernise how politics works. Now, as CEO of Nostrada.ai, Emirali’s work sits at the intersection of AI, lobbying, and the unpredictable machinery of government.

-

Thames Water’s record £1.65bn loss deepens nationalisation fears in the UK. As creditor talks stall, the crisis exposes wider risks in highly leveraged utilities and signals stricter oversight for the sector.

-

Trump Media has filed two AI-related trademarks for Truth Social. The move comes as major tech and media platforms accelerate AI branding amid rising regulatory scrutiny and litigation over digital innovation.

-

UK corporates now account for more than three-quarters of new electric vehicle registrations. Flexible schemes and company-wide adoption are accelerating the transition, as businesses move ahead of private drivers.

-

US-backed buyers led five major UK M&A deals this week. Boardroom shifts, valuation gaps, and sector-specific drivers shaped property, industrials, and tech transactions, with most deal value remaining in the mid-market.

-

Most UK boards still lack dedicated oversight for digital risk. As AI, cyber threats, and investor scrutiny accelerate, corporate governance structures are straining to keep pace. A new BQX feature explores how boards are responding — and what practical steps they must take to stay ahead.

-

This year’s Christian Horner situation illustrates the complexity of leadership scandals. Boards must balance stability, scrutiny, and resilience in times of executive crisis.

-

Five US transactions lifted M&A volumes in a shortened week. Regulatory clarity and strategic appetite drove landmark acquisitions by HPE, Home Depot, Boeing, AbbVie, and Thoma Bravo, marking a renewed focus on scale, sector positioning, and technology leadership.

-

Foreign buyers drove this week’s top M&A deals in Britain. UK assets continued to attract overseas and private-equity capital, with five major transactions totalling more than £18 billion announced or completed across financial services, industry, and property sectors.