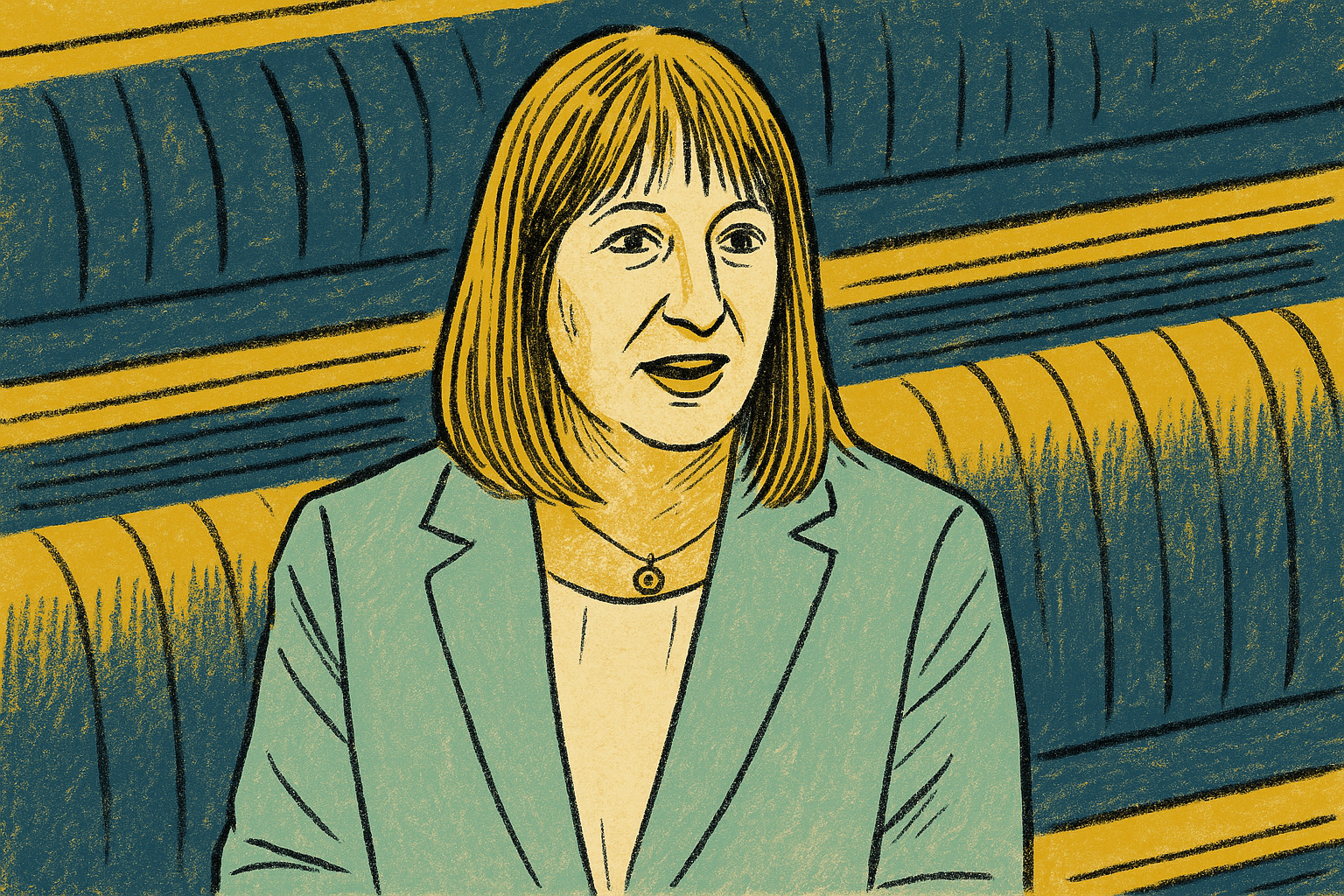

Rachel Reeves has intensified her appeal to business leaders to promote a positive outlook on the economy ahead of the Autumn Budget. The Chancellor has cautioned that failing to support a favourable economic narrative could inadvertently aid Nigel Farage’s rise to Prime Minister.

According to the Financial Times, the Treasury has warned top business executives that further economic pessimism could strengthen Reform UK’s position. A business leader told the Financial Times, “We’ve been told that if you want to talk down the economy it will only help Reform, and do you want that as the alternative?”

These warnings come despite accusations against Rachel Reeves and Keir Starmer for previously criticising the economy post-2024 election, where the government described parts of Britain as “broken”.

Labour officials have cautioned that a Reform government could destabilise the economy by challenging the Bank of England and undermining Starmer’s new EU relations. Meanwhile, Reform has been engaging with business figures, advocating for low spending and tax policies to gain support.

A recent survey by The Institute of Chartered Accountants in England and Wales (ICAEW) revealed that business confidence has plummeted to a three-year low due to tax concerns. Researchers noted that six in ten businesses cited the tax burden as a “growing concern”, with levels reaching a historic high after a ten-fold increase over the past five years.