Some of the largest traditional banks in the UK have closed more than one-third of their branches over the past five years as they shift focus from the high street to enhancing their digital services. Data from the Office of National Statistics indicates a decline in the number of bank, credit union, and building society branches from 10,410 in 2019 to 6,870 in 2024, marking a 34% reduction.

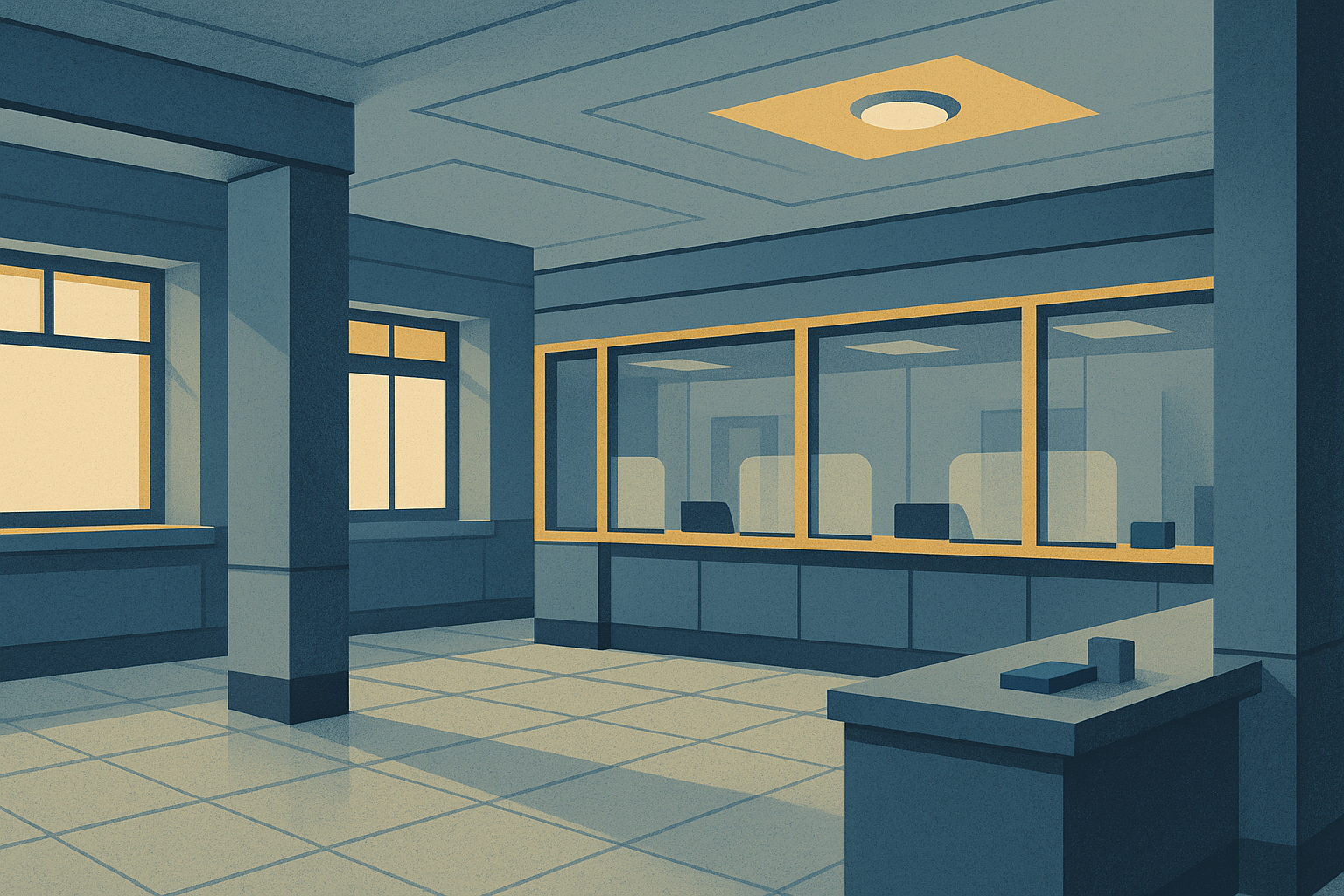

Branch closures have continued to rise in 2025, with NatWest, Halifax, Lloyds, and Bank of Scotland planning to shut 113 branches by the end of November. In March, Santander announced the closure of 94 out of its 444 UK branches, with 14 sites closing this month. Nationwide remains one of the few traditional lenders not undertaking closures, committing to keep its branches open until at least early 2028.

According to management consultancy Kearney, the UK is among the European countries with the highest number of bank branch closures, with only Spain and the Netherlands surpassing it by closing 37% and 48% of their branches, respectively, over five years. The closures align with a shift towards online banking, with the percentage of customers using digital methods rising from 33% to 59% between 2020 and 2024.

Sameer Pethe, a partner at Kearney, explained to the Financial Times that this shift is not merely about closing branches or cutting costs. He noted, “It’s a clear signal that high street banks are reshaping their operating models, doubling down on digital as online becomes second nature for most customers.”

Traditional banks have been working to retain customers and compete with fintech challengers such as Monzo, Chase, and Revolut. Peter Tyler, director of personal banking at UK Finance, stated, “The way that we bank has been changing for some time, with a shift to digital services which is driven by customer demand.” This shift has led to a decrease in branch footfall.

However, the growing number of closures has sparked customer backlash, particularly among those concerned about losing access to cash services, with elderly and vulnerable account holders being most affected. To address these concerns, the previous government introduced the Access to Cash legislation to prevent UK towns and villages from becoming “banking deserts.” Last year, the Financial Conduct Authority (FCA) mandated that banks and building societies assess local cash access and provide alternative services where necessary.

In response, the banking sector has established “banking hubs” where customers of major lenders can conduct cash transactions. In 2024, banks agreed to create 350 hubs on UK high streets by 2029, operated by the Post Office, with 179 already in operation.