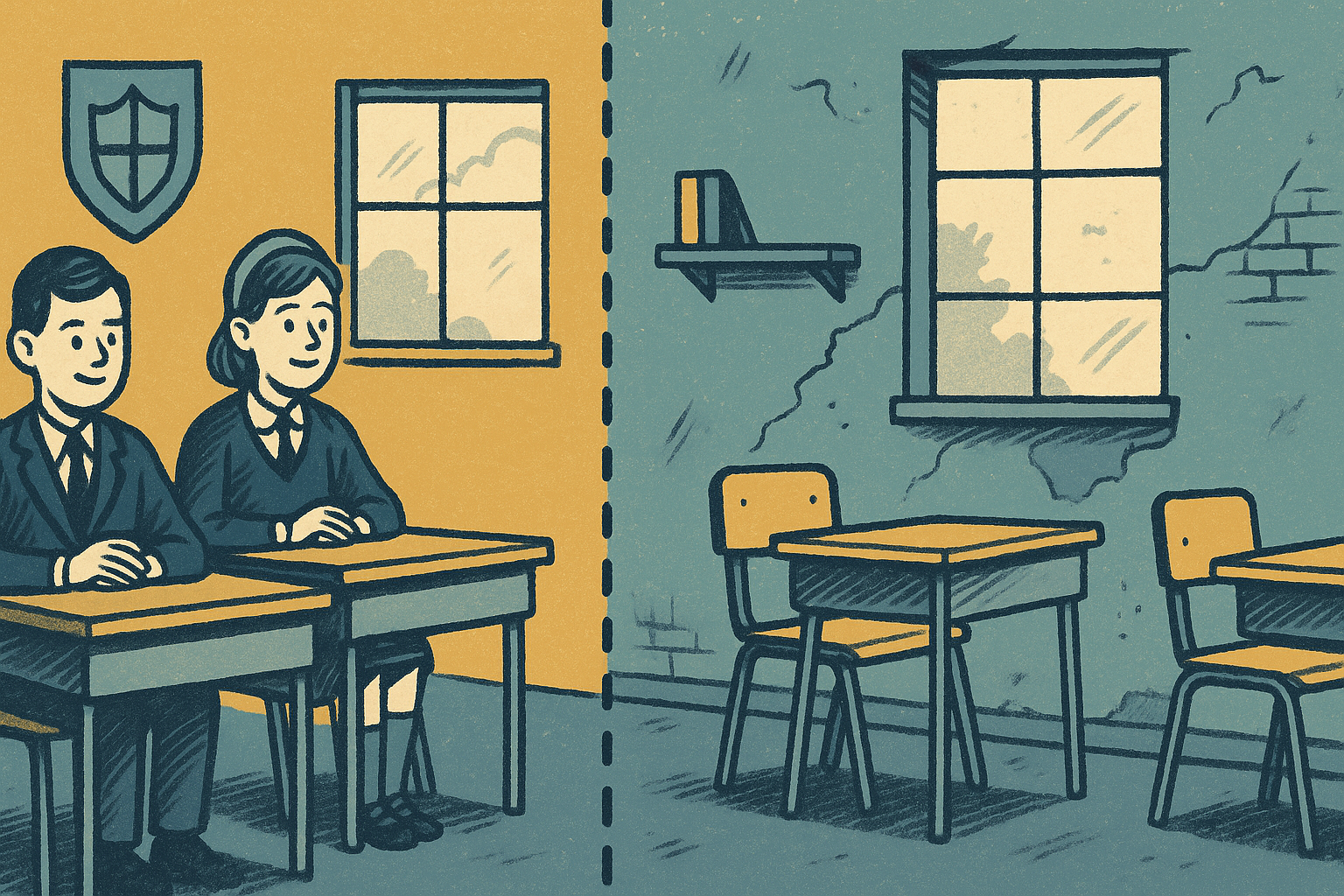

The High Court has ruled against a legal challenge by families and private schools seeking to overturn Labour’s policy applying 20% VAT to private school fees.

Judges today dismissed all claims in the judicial review, a major setback for families of private school pupils who argued the tax violated human rights and unfairly targeted vulnerable groups.

The policy, central to Labour’s education funding reforms, took effect in January 2025 and is expected to generate £1.5 billion in its first year, increasing to £1.7 billion annually by 2029/30, according to the Office for Budget Responsibility (OBR).

The case was initiated by three groups of families, mostly anonymous, along with independent schools. Their lawyers contended that the VAT violated children’s right to education under the European Convention on Human Rights and discriminated against:

- Pupils with special educational needs (SEN)

- Families pursuing faith-based education

- Children requiring single-sex learning environments

Stephen White, whose four children attend Bradford Christian School, was one of the named claimants. He participated in a protest outside the High Court in April with other parents. The protestors underscored the absence of suitable state alternatives for their children, particularly those with SEN or specific religious needs.

Families of SEN children were especially outspoken, asserting that private provision was their only option due to the inadequate state system. They cited a National Audit Office (NAO) report describing state SEN services as “unsustainable,” a view shared by Education Secretary Bridget Phillipson, who described the system as “broken.”

Nevertheless, the court deemed evidence from the NAO report inadmissible, citing legal technicalities as it involved parliamentary proceedings, which weakened the claim.

Government lawyers, led by Sir James Eadie KC, defended the policy in court as necessary, proportionate, and fair. They mentioned that exemptions for SEN or religious education were considered during consultations but were dismissed for being “revenue diminishing, unfair, unworkable and/or administratively onerous.”

They argued the VAT is part of a broader strategy to fund public services, including state schools and teacher recruitment, while improving tax system fairness.

Children with an Education, Health and Care Plan (EHCP) remain exempt from the VAT, but critics claim this only covers a small percentage of SEN pupils, leaving many families without support.

The ruling has sparked political disputes regarding the allocation of VAT revenue. Labour initially vowed to