-

The UK’s M&A market saw five major deals this week. Strategic buyers, from Wall Street banks to dairy giants, drove activity across financial services, consumer, and biotech sectors. Global capital, succession, and sector shifts shaped the dealmaking landscape.

-

UK small and medium-sized businesses now invest over £1 trillion annually in technology. New data highlights rapid digital adoption, with 99% of firms now reliant on digital tools and platforms.

-

Britain’s steelmakers regain EU tariff-free access for Category 17. From 1 August, UK producers can export up to 27,000 tonnes of structural steel to Europe each quarter, restoring trade volumes and offering vital certainty for the sector after years of Brexit-linked restrictions.

-

US tariffs are reshaping the UK’s trading relationship with America. British businesses face a 10% baseline tariff on most exports, with new sector-specific quotas and compliance hurdles fundamentally altering access to the world’s largest market.

-

The British pound is experiencing its sharpest monthly fall. Sterling has fallen 3.6% against the US dollar in July, pressured by UK economic challenges and changing global sentiment, marking its worst monthly performance since September 2023. Analysts expect continued pressure due to fiscal concerns.

-

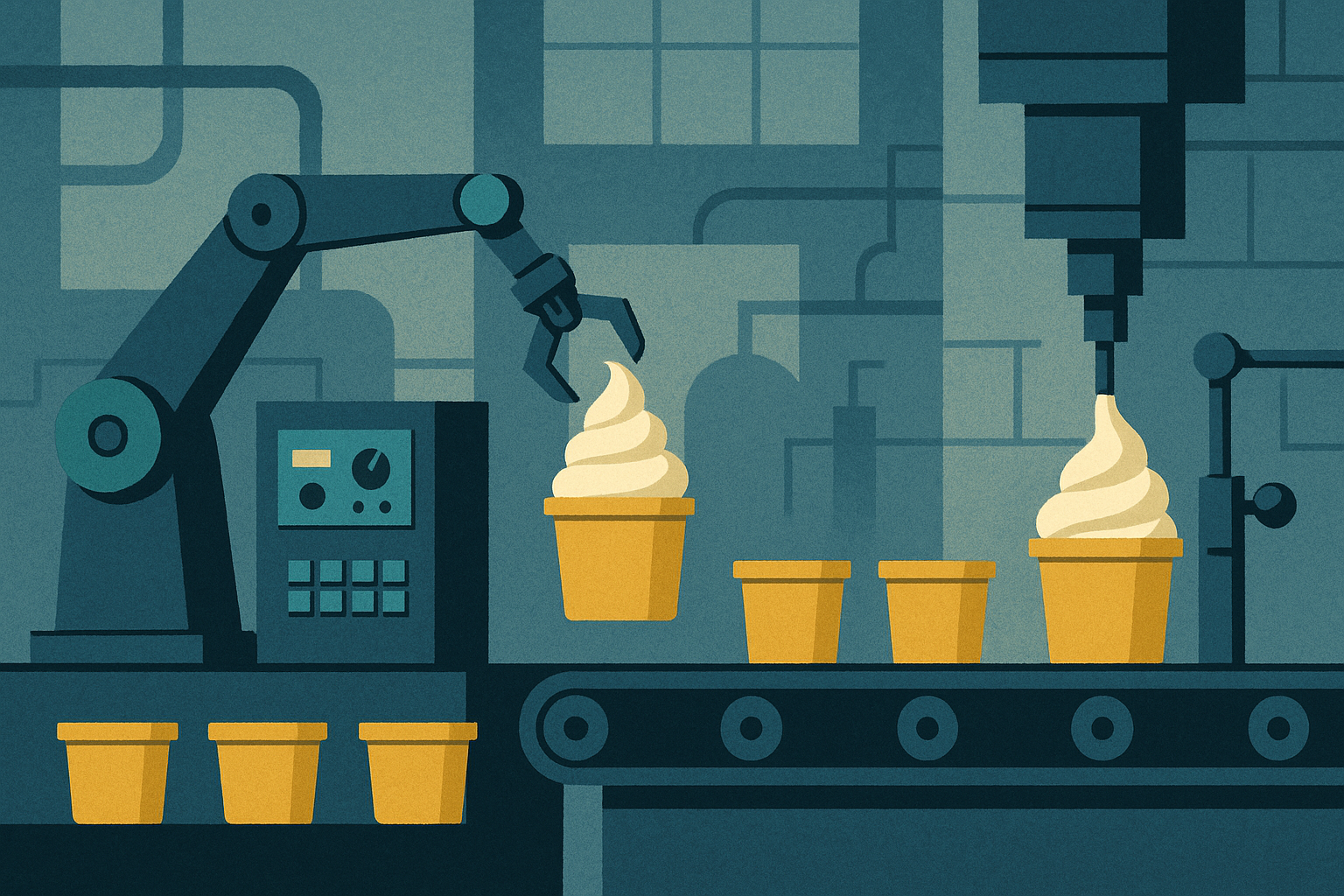

Unilever’s sales rose 3.4% amid challenging profit figures. The FTSE 100 firm reported a 3.2% drop in turnover to €30.1bn, citing disposal costs and currency impacts. Ice cream led growth ahead of its spinout, while cash flow and earnings fell.

-

A sweeping set of late-payment laws will soon apply to UK corporates. New 45-day payment caps and multi-million-pound fines for repeat offenders are now set to reshape supplier relationships and boardroom behaviour, amid calls for greater corporate accountability and overdue relief for small businesses.

-

UK business confidence has reached its highest level since 2015. The Lloyds Bank Business Barometer shows optimism climbing for a third straight month in July, with hiring intentions and services sector strength offsetting ongoing cost pressures and uneven regional trends.

-

The UK’s ageing workforce is growing fast. Employers are investing less in training just as older workers face new risks from AI and the net zero transition. New CIPD research calls for urgent action to support reskilling and lifelong learning to keep older staff in work.

-

Cohort Capital has issued a £96 million loan facility. The transaction will refinance two four-star hotels in London and the North.