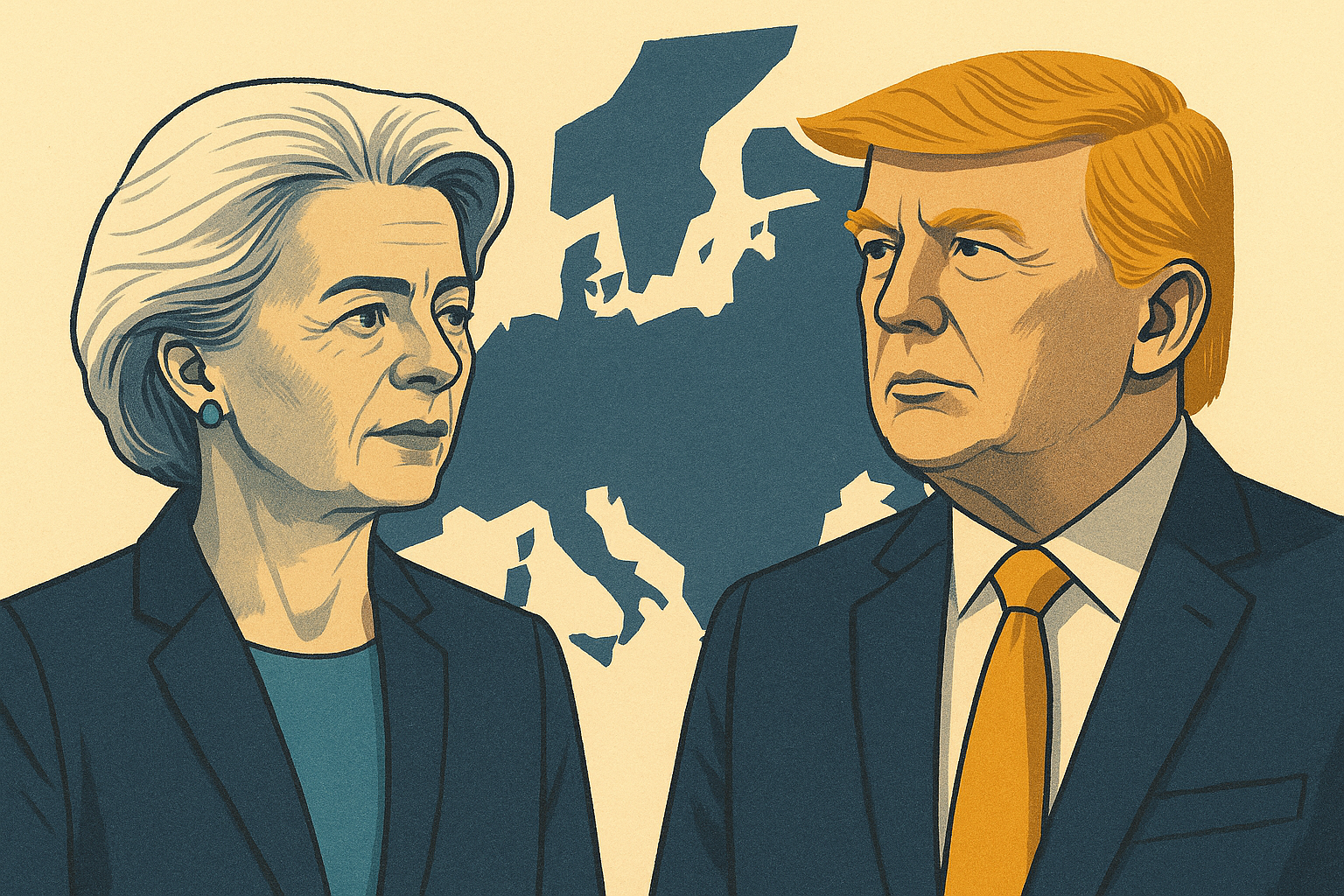

At Donald Trump’s Turnberry resort in Scotland, a last-minute diplomatic marathon produced what both Washington and Brussels called a “good deal for everybody.” The relief, however, was short-lived for many in Europe’s business community. Instead of a catastrophic 30% tariff on all EU exports to the United States, European firms now confront a new and permanent 15% baseline — the highest in nearly 90 years.

While German officials cautiously welcomed the agreement as a pragmatic solution, their French counterparts were blunt: “A dark day,” declared France’s prime minister, lamenting what he described as “submission” to US demands. The United States, meanwhile, hailed the outcome as a “$1.35 trillion” victory, pointing to new commitments from Europe to purchase American energy and spur investment. Yet the European Commission quietly stressed that these headline figures are not legally binding, merely political commitments interpreted differently on both sides of the Atlantic.

For European business leaders, the real meaning of the July agreement is now clear. A full-blown trade war may have been avoided, but it has been replaced by a new reality — the institutionalisation of tariffs as a permanent cost of doing business with the world’s largest market.

Winners, losers, and new strategies —

The centrepiece of the deal is a 15% “ceiling” on most EU exports to the US, effective from 1 August 2025. This is not a flat surcharge but is calculated as 15% minus each product’s existing Most Favoured Nation (MFN) tariff rate. For sectors such as automotive, pharmaceuticals, and electronics, this resets the cost structure for European exporters overnight.

The deal includes some important carve-outs. Notably, European aircraft and component makers secured a total exemption, maintaining a decades-long policy of zero tariffs for this sector. Certain chemicals, generic medicines, and raw materials also remain protected. Conversely, punitive 50% duties on steel, aluminium, and copper persist, with only limited relief through managed quotas. According to the Federation of German Industries, these unresolved penalties remain a “disastrous signal” for heavy industry.

The economic impact has been swift. Capital Economics estimates the new tariff regime will shave 0.5% from EU GDP, while the European Commission has downgraded its 2025 growth forecast to just 1.1%, citing US trade policy as the main drag. Germany’s government has called the outcome a “pragmatic success,” highlighting reduced car tariffs from a threatened 27.5% to 15%. But business leaders are clear that this still represents billions in new costs annually. Porsche, exposed entirely to export tariffs, took a €400 million charge to protect US-bound customers from price hikes, while BMW is relying on its US manufacturing base to limit financial fallout. “Our footprint in the US is helping us limit the impact of tariffs,” said CFO Walter Mertl, though the company still expects a 1.25 percentage point hit to its 2025 profit margin.

French and Italian exporters, meanwhile, see little upside. The 15% tariff applies to luxury goods, wine, and spirits — major export categories for both countries. “We are selling parts of our culture… so we have no intention of responding to the measure,” said Kering’s CEO, as LVMH shares slid on the news. For the Bordeaux wine industry, the US is the largest single export market, worth €400 million annually. Industry leaders warn that the new tariff will force difficult choices: pass costs to consumers or absorb losses. UBS analysts estimate luxury brands may need to raise US prices by 2% or accept a 3% earnings hit.

For the UK, which secured a lower 10% baseline in a separate agreement, the outlook is mixed. While the headline figure is better, strict quotas cap automotive exports to just 25,000 vehicles per quarter. Any excess faces a 27.5% rate. Aston Martin’s reaction was blunt: the quota is “extremely disruptive” and does little to reassure manufacturers who source or build across both the UK and EU.

The broader strategic lesson for European business is clear: resilience and flexibility now matter as much as efficiency. The days of “just-in-time” global supply chains are over. Leading firms are doubling down on US-based production and fast-tracking diversification into other markets. Italy’s Confindustria, for example, is urging the EU to accelerate trade deals with blocs such as Mercosur and ASEAN to offset US dependency. Financial chiefs now find themselves modelling profit scenarios around tariff shifts and supply chain disruptions as a matter of routine.

Geopolitics and the new world order —

The July deal signals more than just higher costs. It marks a turning point in global economic governance, eroding the principles of the World Trade Organization and normalising tariffs as tools of international strategy. By agreeing to negotiate under the threat of punitive US action, Europe has, in the words of the Peterson Institute for International Economics, “legitimised a law of the jungle approach” where power trumps process.

Many analysts argue the EU’s “strategic autonomy” has been exposed as wishful thinking. The new commitments to US energy and defence spending deepen, rather than reduce, European dependence on Washington. According to the Center for Strategic and International Studies, the agreement represents “a geopolitical victory for the US, in which Brussels consciously chose to accept economic costs to preserve the transatlantic security alliance,” especially in the context of ongoing conflict in Ukraine.

For European business leaders, the way forward demands realism and agility. Tariff and trade volatility must now be treated as permanent features of the global landscape. Boardrooms are urged to invest in resilience — from localising supply chains to engaging policymakers through industry associations. The pursuit of new trade partnerships beyond the Atlantic is no longer optional, but essential.

The 15% tariff era is here to stay. For Europe’s exporters, the cost of access to the world’s largest market has been fundamentally — and permanently — rewritten.