The United Kingdom and India are set to sign a landmark free-trade agreement (FTA) in London between 23 and 24 July, marking the culmination of over three years of negotiations. The deal, finalised in May, is expected to enter into force in early 2026, pending legal ratification by both sides.

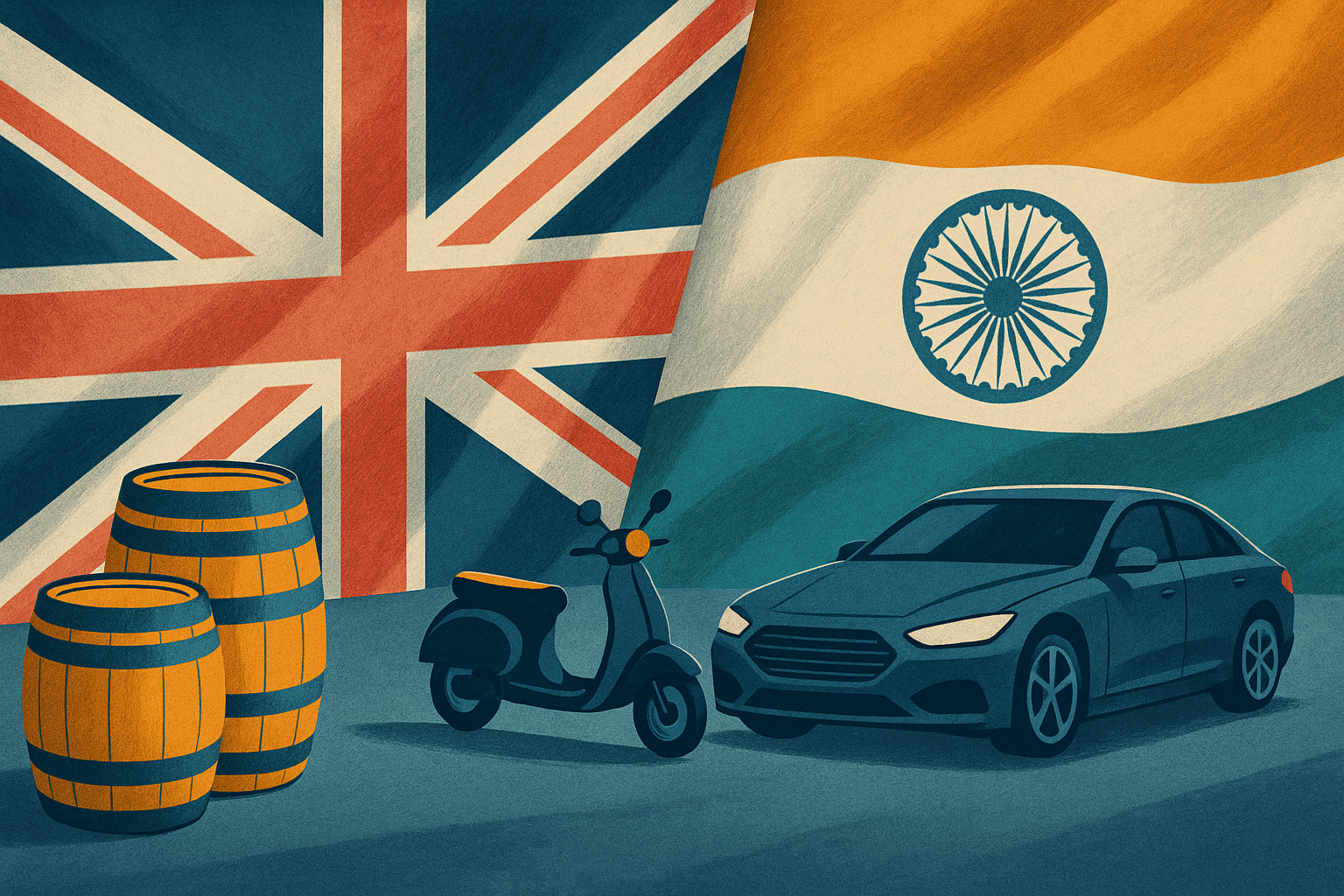

It will eliminate tariffs on 99% of Indian exports to the UK, including textiles and electric vehicles, while sharply reducing duties on major UK exports to India. Scotch whisky tariffs will fall from 150% to 75% on day one, with a further staged reduction to 40% over the next decade. For UK-built premium cars, tariffs will drop from 100% to 10% under an initial 40,000-vehicle quota.

Government modelling forecasts the agreement will deliver a £4.8 billion annual boost to UK GDP and generate an additional £25.5 billion in bilateral trade. Prime Minister Narendra Modi’s visit — his first to the UK since 2018 — will coincide with the official signing, reaffirming political ties under the Starmer government.

“This deal shows Britain remains open, global, and ambitious,” said a senior Downing Street official. “It strengthens supply chains, lowers costs, and puts British expertise on the world stage.”

Key provisions also include India’s first-ever commitment to opening its public procurement market — an estimated £38 billion in annual tenders — and new binding obligations on environmental, gender, labour, and anti-corruption standards. The agreement will exempt three-year secondments from UK national insurance and increase the business visitor quota, though the mobility carve-outs have drawn criticism from UK unions and Conservative back-benchers.

Scotch whisky producers expect to see up to £1 billion in new exports over five years as they expand their share of the Indian market. India is already the top global destination for Scotch by volume, with 192 million bottles shipped in 2024.

UK automotive brands including Jaguar Land Rover and Aston Martin will benefit from sharply lower duties, reducing the cost of a £115,000 Range Rover in India by approximately £23,000. Indian textile exporters, meanwhile, stand to gain from the removal of 9–12% UK tariffs, improving their competitiveness against peers in Bangladesh and Vietnam.

City financial firms are also likely to benefit from the easing of equity caps in India’s insurance sector, alongside new provisions for digital trade and mutual recognition of professional qualifications.

While the deal is being hailed as a post-Brexit success story, challenges remain. UK parliamentary scrutiny and Indian cabinet approval are expected later this year, and implementation hinges on alignment of regulatory codes and technical standards.

Carbon-border-tax clauses and digital trade cooperation remain sensitive issues. However, the deal avoids enforceable sanctions in favour of collaborative mechanisms — a compromise that reflects ongoing tensions in global climate and trade policy.