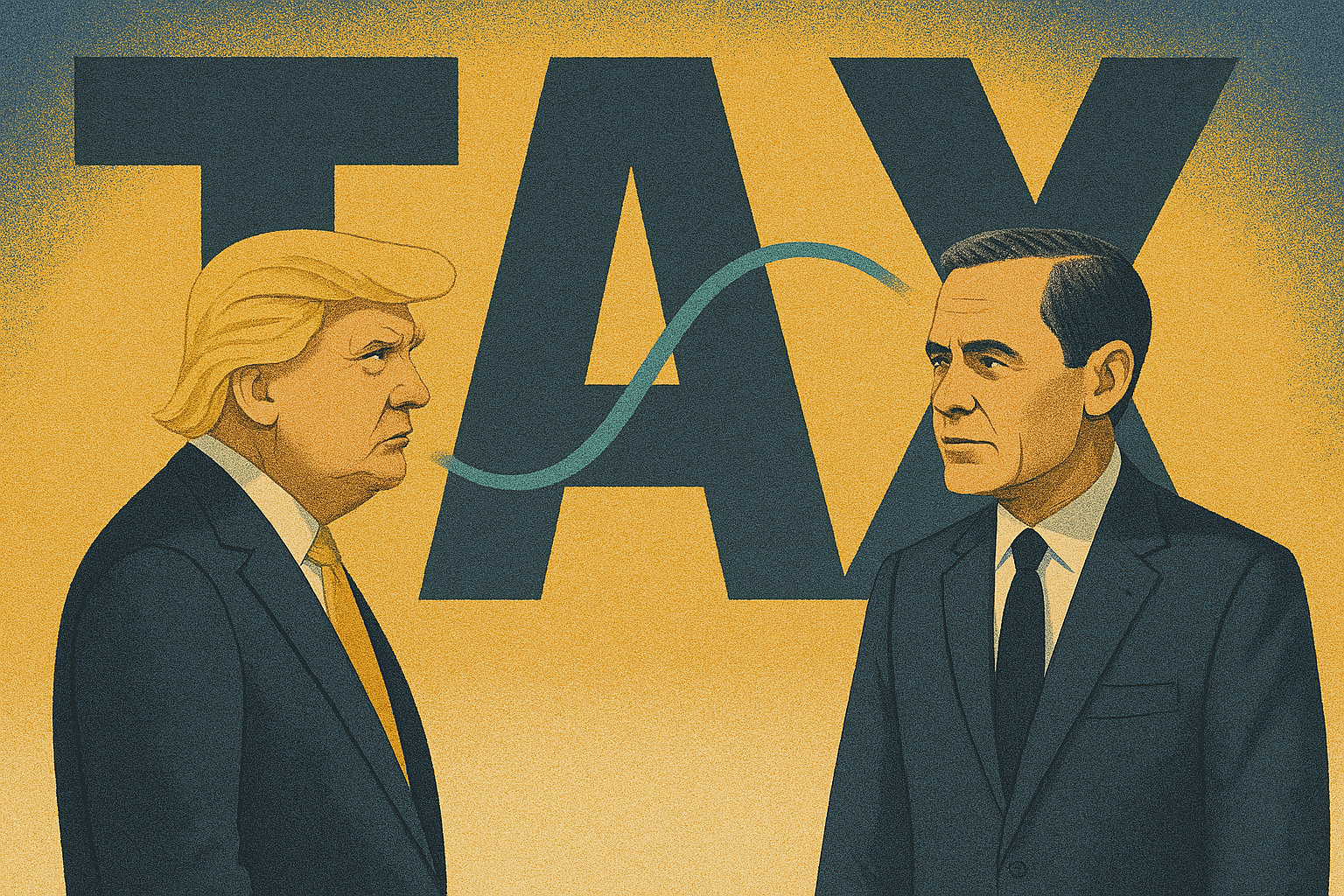

Canada has paused the implementation of its controversial digital services tax just hours before it was due to take effect, in a move aimed at reviving stalled trade negotiations with the United States. The tax, which would have primarily targeted American tech giants, had drawn fierce criticism from President Donald Trump, who abruptly halted talks on Friday and threatened retaliatory tariffs on Canadian goods.

In a statement on Sunday, Canada’s finance ministry confirmed the suspension, adding that Prime Minister Mark Carney and President Trump would resume negotiations immediately with a goal of reaching a new bilateral trade deal by 21 July. The sudden breakdown in talks followed a meeting between the two leaders at the G7 summit earlier this month, where they had committed to finalising a new economic agreement within 30 days.

The Canadian government said the decision to delay the digital tax was taken “in good faith to ensure the smooth continuation of trade talks and avoid escalating tensions at a sensitive moment for both economies.” While Ottawa maintains that the tax is a fair response to the growing profits of digital platforms operating in Canada without paying proportional taxes, the move to delay it signals a clear willingness to compromise in the face of rising trade risks.

Washington has long opposed unilateral digital levies, arguing that such measures unfairly target US firms and should instead be addressed through multilateral OECD-led reforms. Trade observers now expect a renewed push toward broader tax and trade alignment between the two countries ahead of the July deadline.