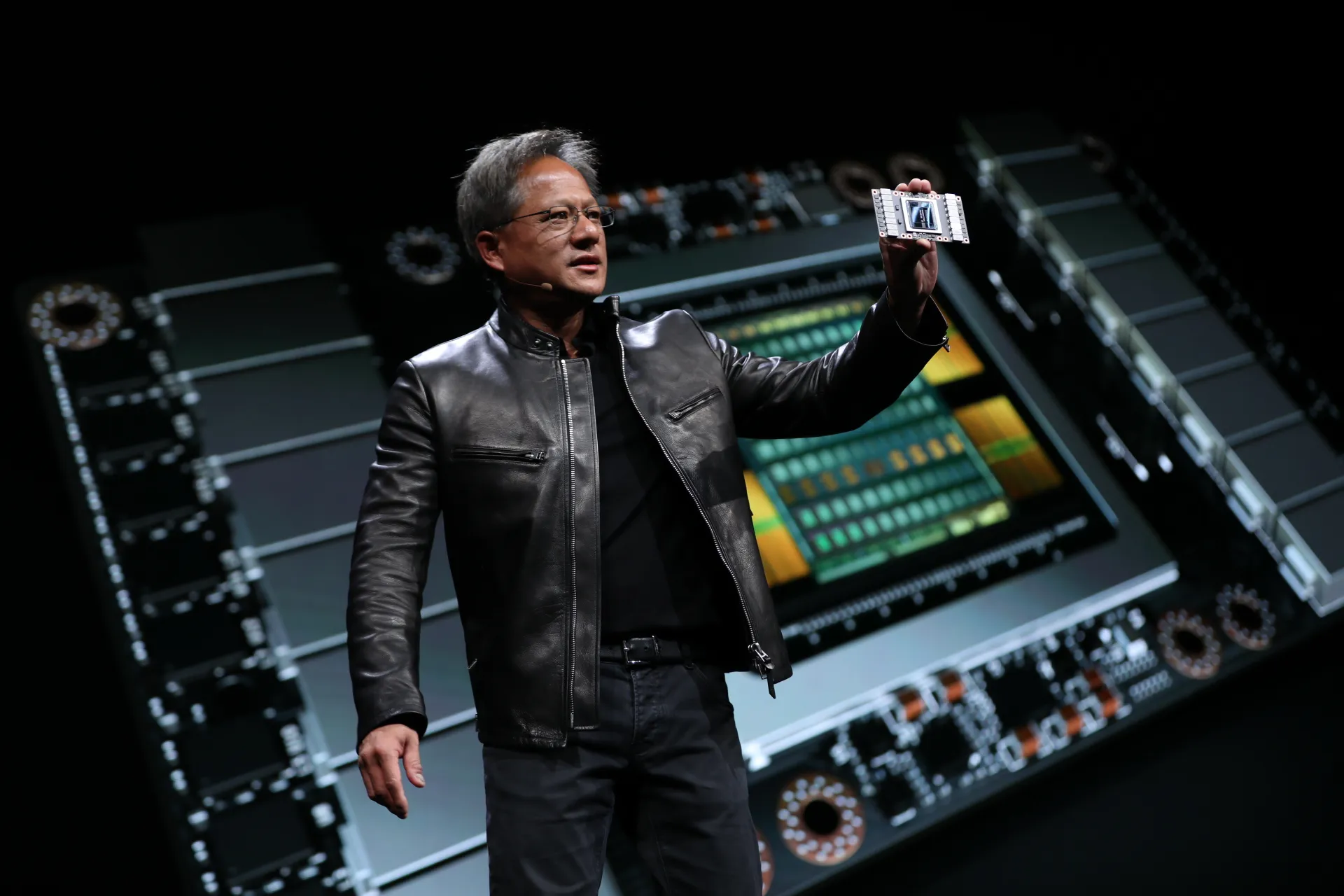

Nvidia CEO Jensen Huang has described US restrictions on the export of high-performance AI chips to China as “a failed policy,” arguing that the measures have weakened American competitiveness while hastening the rise of Chinese domestic alternatives.

Speaking at the Computex conference in Taipei, Huang warned that US trade controls had inadvertently catalysed China’s ability to develop homegrown AI capabilities — both in hardware and software. “The fundamental assumptions that led to the AI diffusion rule… have been proven to be fundamentally flawed,” he said.

Nvidia, which once held a near-monopoly on China’s AI chip market, has seen its share fall from 95% to around 50% in just four years. The company has written off more than $5.5 billion in inventory tied to its H20 chips — originally designed to comply with US export rules — and has forecast a further $15 billion in lost revenue linked to the restrictions.

The US measures, introduced under both the Biden and Trump administrations, were intended to block China’s access to the most powerful chips used in AI model training. But Huang claims the policy has backfired. “China has a vibrant technology ecosystem,” he said, pointing to companies like Huawei, Baidu and DeepSeek, which are already building competitive AI infrastructure. “You can restrict them from buying, but you cannot restrict them from innovating.”

The remarks come as reports emerge that the Trump campaign is considering a rework of current restrictions, possibly shifting towards a licensing regime that would allow some controlled exports. Nvidia has signalled support for such a move, arguing that narrow restrictions targeting military use would be more effective than sweeping commercial bans.

For the broader market, Huang’s comments feed into growing investor scepticism over blanket export controls. Semiconductor stocks have weathered volatility in recent months, with chipmakers caught between expanding global demand and escalating geopolitical risk. Shares in Nvidia, which surged to a $2.5 trillion valuation this spring, have come under pressure amid China-linked uncertainty.

Analysts at Jefferies noted this week that Chinese AI companies are ramping up investments in domestic silicon, particularly as state subsidies accelerate chip design and manufacturing capacity. Meanwhile, Beijing’s recent procurement preferences — prioritising Chinese-built AI systems in public projects — further restrict Western chipmakers’ routes to market.

In Europe, the developments raise strategic questions for AI hardware procurement and dual-use technology regulation. With the EU pursuing its own AI Act and digital sovereignty agenda, Nvidia’s experience highlights the risks of fragmented export regimes and retaliatory industrial policy.