The former CEO of Centrica, Sam Laidlaw, is among the candidates being considered for the chairmanship of BP. He could succeed Helge Lund, who announced plans to step down in April.

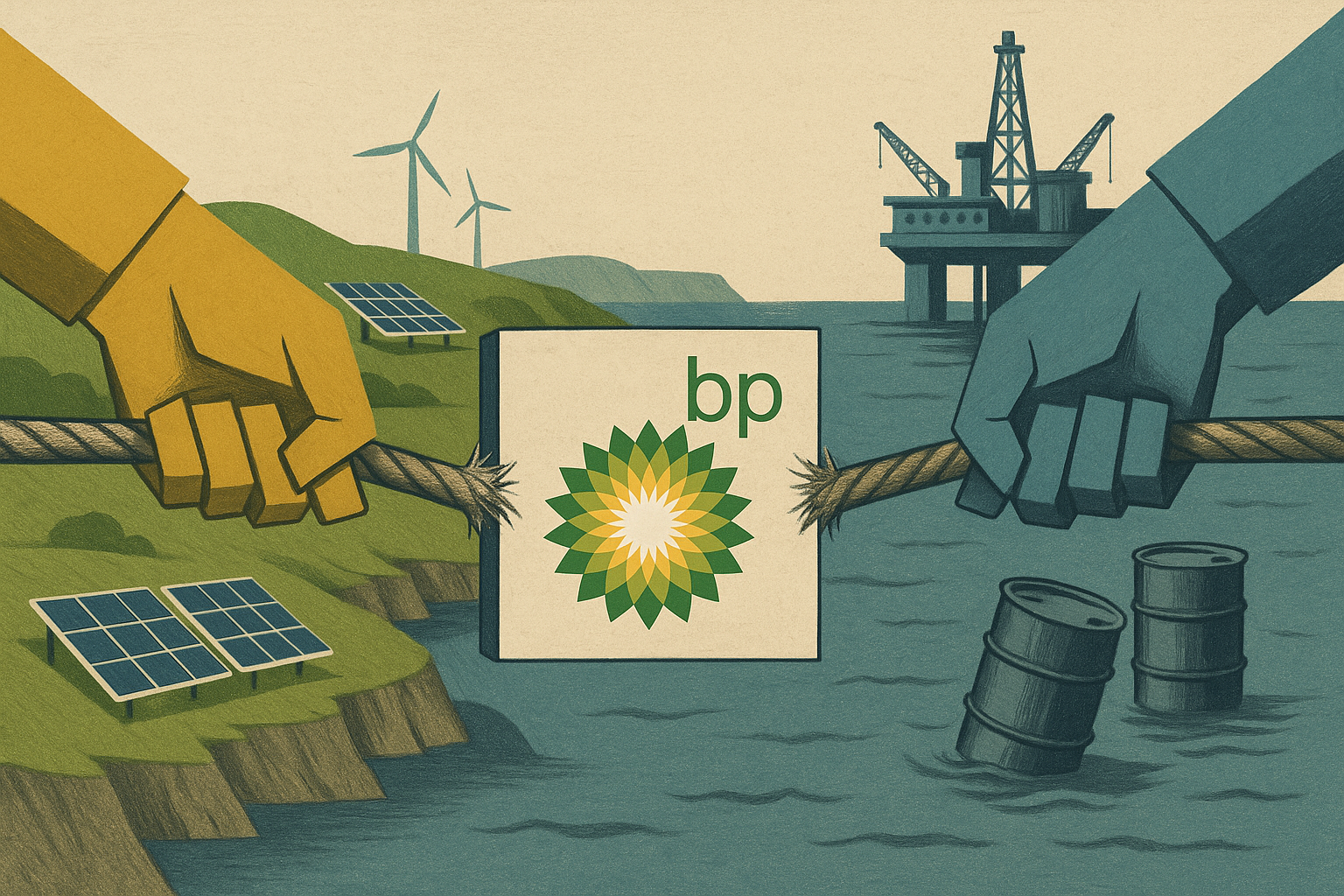

The search for a new chairman comes as BP faces pressure from shareholders to quicken its strategic transformation. Activist investor Elliott Management, which acquired a significant stake in BP earlier this year, has urged the company to abandon its renewable energy commitments and focus more on cost-cutting measures. This has led to tensions, with nearly a quarter of shareholders voting against Lund’s re-election at the annual general meeting in April, protesting the scrapping of climate goals.

Lund, who played a pivotal role in BP’s green agenda, will step down in April 2026. Laidlaw’s experience with activist investors, such as his role on the board of Rio Tinto, positions him as a potential front-runner for the BP chairmanship.

BP has faced various challenges, including a reduced quarterly share buyback following a decline in oil prices linked to former President Donald Trump’s tariff policies. The company decreased its buyback to $750 million, down from $1.75 billion in the previous quarter. BP’s cash flow from operations has fallen to its lowest level since late 2020, and net debt has risen by $4 billion.

Elliott Management has projected that BP could achieve free cash flow of $20 billion by 2027, which is significantly higher than the company’s current target. Additionally, BP has been at the centre of takeover speculation, with rivals Shell and ExxonMobil reportedly considering potential acquisitions due to BP’s declining share value. However, these talks have not yet led to any formal offers.